Venturing into the dynamic realm of foreign exchange trading can be a thrilling endeavor, offering immense potential for profitability. Yet, navigating this complex market requires a well-defined strategy to maximize your chances of success.

Successful forex traders often employ a range of strategies tailored to their individual profile. Some popular approaches include swing trading, which focus on quick price fluctuations, while others prefer position strategies that aim to capitalize on broader market trends.

- It's crucial to conduct thorough research and analysis before implementing any strategy.

- Graphical analysis involves examining price charts and patterns to identify indications.

- Economic analysis, on the other hand, considers factors such as interest rates, economic growth, and political events.

Effective risk management is paramount in forex trading. Traders should always use stop-loss orders to cap potential losses and diversify their portfolios to spread risk across multiple currency pairs.

The Forex Factory : Your Gateway to Market Insights and Understanding

Navigating the dynamic world of foreign exchange markets can be a complex endeavor. Therefore, Forex Factory emerges as an invaluable resource for traders of all skill sets. Whether you're a seasoned professional or just beginning your forex journey, this comprehensive website provides a wealth of knowledge to empower your trading approach.

- Advantage: Access a vast library of real-time market data, including currency rates, economic indicators, and technical graphs.

- Benefit: Interact in lively forums centered to specific currency pairs and trading techniques. Share your insights, learn from experienced traders, and build a network of like-minded individuals.

- Advantage: Stay ahead of the curve with expert analysis, market reports, and educational tutorials.

Forex Factory's intuitive interface and user-friendly design make it simple for traders of all technical abilities. It's a one-stop center for everything you need to succeed in the forex market.

Understanding Forex: A Beginner's Guide to Currency Trading

Embark on your journey into the dynamic world of foreign exchange market participation. Forex, short for foreign exchange market, involves the acquisition and disposal of currencies. It's a vast and liquid marketplace where traders speculate on currency price fluctuations. To begin your forex endeavors, a solid understanding of the basics is crucial.

- Learn about major currency sets: The most common currencies, such as EUR/USD, GBP/USD, and USD/JPY, form the foundation of forex trading.

- Evaluate market patterns: Charting tools and technical analysis techniques can help you recognize potential trading opportunities.

- Formulate a trading system: This outlines your entry and exit points, risk management strategies, and overall trading goals.

- Refine with a demo account: Before investing real money, familiarize yourself with the platform using a simulated trading account.

Remember, forex trading involves inherent risk. Always trade responsibly and seek professional consultation if needed.

Deciphering "Forex คือ": Exploring Thailand's Currency Market

The dynamic forex market in Thailand is a complex and captivating system that drives the nation's economy. Understanding its intricacies is crucial for both businesses and everyday citizens. This article aims to shed light on the world of forex in Thailand, exploring key concepts and outlining its impact on the local financial landscape.

From currency pairs, to market analysis, we'll delve into defining features that shape the Thai forex market. Whether you are a seasoned trader, this exploration will provide valuable knowledge into this dynamic financial ecosystem.

Unveiling Forex Depth: A 3D Approach to Market Analysis

The forex market is forex jumbo renowned for its unpredictability, presenting seasoned traders and newcomers alike with a constant challenge. To effectively analyze this intricate landscape, traders require powerful tools that provide multidimensional insights into price movements. Enter Forex 3D charting, a revolutionary approach that transcends the limitations of traditional two-dimensional charts.

By utilizing three axes to represent price, volume, and time, Forex 3D charting unveils hidden patterns and relationships that would otherwise remain obscured. This enhanced visualization allows traders to identify potential opportunities with greater accuracy, leading to more strategic trading decisions.

- Additionally, Forex 3D charting empowers traders to understand market psychology through the lens of volume fluctuations and price action.

- As a result, traders can gain a deeper understanding of the forces shaping the market, enabling them to make more calculated trades.

Unveiling the World of Forex 3D Trading

Forex 3D trading offers a unique way to analyze the dynamic forex market. Unlike traditional systems, which typically depend upon two-dimensional charts, Forex 3D facilitates traders to interpret price fluctuations in a immersive space. This enhanced perspective can offer valuable data into market dynamics, potentially leading to more strategic trading actions.

- Additionally, 3D charts can display key resistance and formations with greater clarity, aiding traders in recognizing potential exit points.

- Nevertheless, it's essential to approach Forex 3D trading with a strategic understanding of its benefits and limitations.

- Prior to exploring this sophisticated trading landscape, it's highly recommended to meticulously research and experiment with various 3D tools.

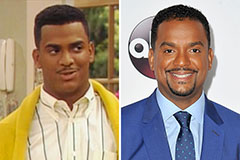

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Jurnee Smollett Then & Now!

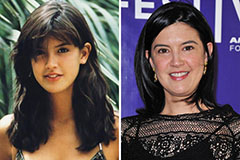

Jurnee Smollett Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!